In late 2017, Branko Milanovic wrote a blog post titled “The illusion of degrowth in a poor and unequal world.” He penned it, he says, following a conversation he had with a proponent of degrowth, which was me. I wrote a response, which I have updated here for clarity, and to account for new data.

To recap Milanovic’s argument: he imagines a scenario in which we cap global GDP at present levels. Poor countries then increase their GDP per capita to the global average, while rich countries decrease their GDP per capita accordingly. He says that this would entail a reduction of production and consumption in the West, with economic activity slashed to one-third of its present size.

For Milanovic, this is dystopic: “Factories, trains, airports, schools would work one-third of their normal time; electricity, heating and hot water would be available for 8 hours a day; cars may be driven one day out of three; we would work only 13 hours per week, etc.—all in order to produce only a third as many goods and services that the West is producing now.” Milanovic calls this “the immiseration of the West,” and he dismisses it as “not even vaguely likely to find any political support anywhere.” Forget about it, he says; we need growth. Let’s focus instead on reducing our consumption of emissions-intensive goods and services by taxing them, and “think about how new technologies can be harnessed to make the world more environmentally friendly.”

Milanovic’s vision here suffers from a number of empirical and analytical flaws. Let me try to explain some of them:

1. World average GDP is not dystopic; it is poorly distributed and poorly utilized

First, a small point to correct the record. World average GDP per capita is $17,600 (PPP). This is not dystopic. On the contrary, it is roughly consistent with the World Bank’s threshold for “high-income”.

This is well in excess of what is associated with very high levels of human development. According to the UNDP, some nations score “very high” (0.8 or above) on the life expectancy index with as little as $3,300 per capita (and over 0.9 with as little as $8,000), and “very high” on the education index with as little as $8,700 per capita. In fact, nations can succeed on all key social indicators represented by the SDGs – not just health and education, but also employment, nutrition, social support, life satisfaction etc. – with as little as $10,000 per capita.

In other words, in theory we could achieve all of our social goals, for every person in the world, with much less GDP than we presently have, simply by investing in public goods and distributing income and opportunity more fairly (right now the richest 5% capture nearly half of global GDP), even within the logic of actually-existing economic frameworks.

But all of this is ultimately irrelevant to the question at hand, because:

2. Degrowth is not about reducing GDP; it’s about resources and energy

This is Milanovic’s first mistake. Degrowth is not about reducing GDP. Rather, it is about reducing excess resource and energy throughput, while at the same time improving human well-being and social outcomes; the literature is quite clear on this. From the perspective of ecology, this is what matters.

Right now, global resource use is about 100 billion tons per year; roughly double what scientists consider to be a sustainable level. This is a major driver of ecological breakdown and biodiversity loss. Global energy use is also too high. The IPCC is clear that we need to significantly reduce global energy use (from 400 EJ today down to about 240 EJ by 2050) in order to enable us to transition to renewables quickly enough to stay under 1.5C or 2C (Grubler et al 2018; IPCC 2018).

Crucially, excess resource and energy use is being driven by rich nations, not poor nations. So, rich nations need to reduce their resource and energy use. We accept that reducing aggregate resource and energy throughput is likely to lead to a slower rate of GDP growth, or perhaps even to a reduction in GDP; it all depends on the rate of efficiency. But even if GDP does end up declining, that’s okay, as we will see. And this brings me to the next point:

3. When it comes to human well-being, counting GDP is irrelevant

Milanovic’s second mistake is that he assumes a one-to-one relationship between GDP and human welfare. When you start from this assumption, you’re likely to conclude (as Milanovic does) that we are in a position of scarcity: clearly there’s not enough for everyone to live well, and we need more (notwithstanding point 1). But this reasoning is problematic because GDP is not, and was never intended to be, a proxy measure for human well-being. Rather, it is a measure of the monetary value of the commodities we produce and exchange for money. Unsurprisingly, there is no causal relationship between GDP and social outcomes. Using it for this purpose is unscientific.

What actually matters for human well-being is provisioning – in other words, people’s access to the resources they need to live long, healthy, flourishing lives. The reason GDP is an unsuitable metric here is because it only counts a very narrow slice of economic activity; specifically, that which has to do with commodity exchange-value. It does not count all forms of provisioning; in fact, much of the provisioning we rely on is totally ignored by, and irrelevant to, GDP. Milanovic knows this.

So it’s quite possible that GDP could go up while provisioning declines; for instance, if the UK National Health Service were privatized, GDP would go up but people’s access to healthcare would be curtailed (the same is true for virtually all forms of privatization or enclosure). Similarly, GDP could go down while provisioning improves; for instance, if the UK government imposed rent controls, or restored public housing, GDP might take a hit but people would have easier access to housing. This trade-off is known as the Lauderdale Paradox.

Now, when we think about the question in terms of resource provisioning, the picture changes quite a bit. It becomes clear that there’s no scarcity at all. Recent research has found that we could end global poverty and ensure flourishing lives for everyone on the planet (for 10 billion people by the middle of the century), including universal healthcare and education, with 60% less energy than we presently use (150 EJ, well within what is considered compatible with 1.5C). As for resource use, we know that high-income nations could meet their citizens’ material needs at a high standard, with up to 80% less resource use, bringing them back within the sustainable threshold.

From this angle, it becomes clear that capitalism is highly inefficient when it comes to meeting human needs; it produces so much, and yet leaves 60% of the human population without access to even the most basic goods. Why? Because a huge portion of commodity production (and all the energy and materials it requires) is irrelevant to human well-being. Consider this thought experiment: Portugal has significantly better social outcomes than the United States, with 65% less GDP per capita. This means that $38,000 of US per capita income is effectively ‘wasted’. That adds up to $13 trillion per year for the US economy as a whole; $13 trillion worth of extraction and production and consumption each year, and $13 trillion worth of ecological pressure, that adds nothing, in and of itself, to human well-being. It is damage without gain.

This should not come as a surprise, because the point of capitalism is surplus extraction, elite accumulation, and reinvestment for expansion – not meeting human needs. To the extent that the system does meet human needs, this is generally the result of political interventions (i.e., unions, labour rights, public provisioning, etc.).

It is irrational to expect that a system organized around increasing extraction and accumulation will somehow automatically improve social outcomes. If improving social outcomes is our goal, it makes much more sense to target that directly, organizing the economy first around what we know is required for human flourishing, rather than just growing the GDP indiscriminately and hoping it will magically provide for people’s needs. And when it comes to human well-being (i.e., health, education, longevity, happiness, life satisfaction), the data is clear: what matters is universal public services, meaningful employment, democracy, and a fair distribution of income.

4. It’s not income itself that counts; it’s the welfare purchasing power of income

Universal public services are important to this vision for a number of reasons. First, they are more cost-effective and less ecologically intensive than their private counterparts (in other words, you get more provisioning for less impact). For instance, Spain’s public healthcare system generates significantly better outcomes than the US system (Spain’s life expectancy is a whole five years longer) with less than one-quarter of the cost and a fraction of the emissions. Public transportation is less intensive than private cars. Public water is less intensive than bottled water. Etc.

Second, public services improve the "welfare purchasing power" of incomes. For instance: if people in the United States didn’t have to pay exorbitant prices for healthcare and higher education, they would need a lot less income to live good lives. In short, Milanovic’s income accounting is meaningless because it’s not income itself that matters; it’s what people can buy with that income, in terms of the goods they need to live well. It’s the welfare purchasing power of income that counts.

And the welfare purchasing power of income is not static; it can be significantly improved. Indeed, this is the objective of degrowth. Research in ecological economics is clear that decommodifying public goods, and de-enclosing commons, is a good way to take pressure off the planet, because it enables people to access the goods they need to live well without needing high incomes to do so (which also means less pressure to work and produce unnecessary stuff, which in turn means less pressure for consumption elsewhere in the system). In other words, it reverses the Lauderdale Paradox.

5. Degrowth does not seek to scale down all sectors; just unnecessary and destructive ones

Milanovic imagines a scenario in which all sectors of the economy are reduced to one third of their present capacity: factories, airports, and schools alike, in equal measure. If that happened, it would indeed be disastrous. But this is not what degrowth calls for; and again, this is something Milanovic would know if he read the literature.

In the existing economy, we operate on the assumption that all sectors must grow, every year, forever, regardless of whether or not we actually need them to. In other words, there is a kind of totalitarian logic to growthism. It doesn’t take much to realise that this is absurd, in terms of both human needs and ecology. Degrowth calls for a more reasonable approach: let’s have a conversation about what sectors still need to grow (like renewable energy, public services, trains, etc), what sectors are big enough already, and what sectors are too big and need to significantly degrow (i.e., fossil fuels, SUVs, advertising, planned obsolescence, McMansions, arms, industrial beef, private jets, etc).

In an actual degrowth scenario, the goal would be to scale down ecologically destructive and socially less necessary production (what some might call the exchange-value part of the economy), while protecting and indeed even enhancing parts of the economy that are organized around human well-being and ecological regeneration (the use-value part of the economy). In other words, it is the opposite of Milanovic’s immiseration scenario.

6. Green growth is not a thing

Milanovic believes that technology will come to our rescue, and make growth “green”. Unfortunately there is a strong consensus against this assumption. We have reviewed the relevant empirical evidence here (“Is green growth possible?”), examining both CO2 emissions and resource use.

Briefly, about CO2, the question is not whether GDP can be decoupled from emissions (we know that it can be), the question is whether this can be done fast enough to stay within safe carbon budgets while growing GDP at the same time. And the answer to this is no. More growth entails more energy use, and more energy use makes it all the more difficult to cover that demand with renewables. The only scenarios that succeed in reducing emissions fast enough to keep us under 1.5 or 2C involve a reduction in resource and energy use (in other words, degrowth). I discuss this in more depth here. This 2020 review examines 835 empirical studies and finds that decoupling alone is not adequate to achieve climate goals; it requires what the authors themselves refer to as “degrowth” scenarios. This paper in Nature Sustainability comes to similar conclusions.

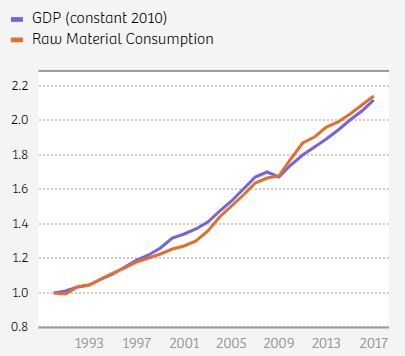

As for resources: resource use continues to rise along with GDP (despite significant efficiency improvements, and a significant shift to services and knowledge as share of GDP), and indeed all existing models indicate that absolute decoupling is unlikely to happen, even under strong policy conditions. See here and here for more.

Ward et al (2016) find that even the most optimistic projections of efficiency improvements yield no absolute decoupling in the medium and long term. The authors state: “this result is a robust rebuttal to the claim of absolute decoupling”; “decoupling of GDP growth from resource use, whether relative or absolute, is at best only temporary. Permanent decoupling (absolute or relative) is impossible… because the efficiency gains are ultimately governed by physical limits.” Schandl et al (2016) find the same thing. Even in their best-case scenario projection, global material consumption still grows steadily. The authors conclude: “Our research shows that while some relative decoupling can be achieved in some scenarios, none would lead to an absolute reduction in energy or materials footprint.”

Our review was published in 2019, and the literature on this has grown since: i.e., here and here… the latter paper reviews 179 studies on decoupling published since 1990 and finds “no evidence of economy-wide, national or international absolute resource decoupling, and no evidence of the kind of decoupling needed for ecological sustainability.” Here is a 2020 meta-analysis of all available data on GDP and resource use, which comes to the same conclusion.

*

In sum, it is irrational to hope, against the evidence, that our existing economic system will deliver the development outcomes we want while at the same time reversing ecological breakdown. We need to be smarter than that. Degrowth provides an empirically-informed alternative: a pathway to reducing excess resource and energy use while at the same time ensuring flourishing lives for all. Given the stakes of the crisis we face, we should be open to fresh thinking.